China. Five companies postpone IPOs

2014-01-15 11:56:58

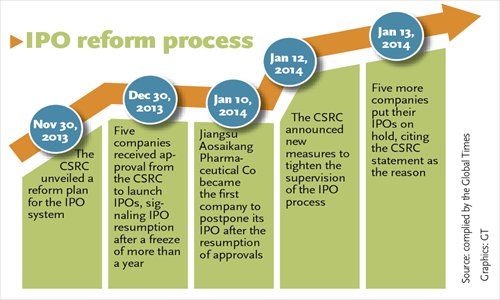

Five firms said Monday they would postpone their IPOs, following the announcement by China's securities regulator of tighter rules, which are aimed at curbing risks for investors.

The five companies were NetPosa Technologies, Hebei Huijin Electromechanical, Nsfocus Information Technology, Beijing Forever Technology and Ciming Health Checkup Management Group. They were originally scheduled to launch share subscriptions for investors on Tuesday.

The postponement came after a weekend announcement by the China Securities Regulatory Commission (CSRC) that it would further tighten supervision of new listings.

Late on Sunday, the CSRC said in a statement that it would terminate an IPO if a company and its underwriter use any information for pricing other than what was in the roadshow prospectus.

Also, any firm whose IPO is priced higher than similar firms in the secondary market must warn investors about this in the three weeks prior to subscription to its shares, with at least one warning each week, the CSRC said.

The CSRC also said it would conduct random spot checks on IPO pricing by institutions.

"The CSRC's new rules are aimed at improving the IPO system, and protecting the interests of retail investors," Dong Dengxin, director of the Finance and Securities Institute at Wuhan University of Science and Technology, told the Global Times Monday.

The regulator might have come across practices such as overpricing or insider trading among firms planning to launch IPOs, he said.

The postponement by the five firms could be a result of concerns about the new rules, or because more time is needed to prepare and release their financial results for 2013 to investors, he noted.

The new rules are "just a patch" for problems in the market, trying to cover up the loopholes left by ineffective IPO reforms, Yuan Shan, a Beijing-based retail investor with 20 years' experience, told the Global Times on Monday.

If the CSRC had done a good job in reforming the IPO system, there would not be so many problems, Yuan said.

A total of 50 firms have received approval from the CSRC to launch IPOs since the end of December, following a 13-month moratorium on approvals that was intended to curb rampant financial fraud and restore investors' confidence in the market.

During the long IPO freeze, the securities regulator released a raft of new measures aimed at moving toward a more market-driven registration system for IPOs, rather than the existing administrative review-based mechanism.

It also encouraged listed firms to share dividends, and to issue preferred stocks and stock buyback plans.

However, there are still concerns about overpricing and insider trading, and confidence in the stock market remains shaky.

The benchmark Shanghai Composite Index and Shenzhen Component Index fell to a five-month low on Monday, dropping by 4.2 percent and 5.3 percent, respectively, since the end of December.

Last week, Jiangsu Aosaikang Pharmaceutical Co postponed its IPO, amid claims in media reports that its shares were overpriced and that one of its existing shareholders was preparing to sell 3.18 billion yuan ($522 million) worth of shares immediately after the offering.

The firm's IPO price-to-earnings (PE) ratio was 67 based on its 2012 financial results, much higher than the average 55.31 PE ratio of its peers already listed on the NASDAQ-style ChiNext board, and higher than other pharma stocks in the A-share market.

Under rules issued on November 30, 2013, qualified existing shareholders of firms that are about to float are allowed to sell their shares as soon as the stock is being publicly traded, instead of the previous three-year lockup period following the issuance of new shares.

Yuan suggested that the securities regulator could calm investor concerns by toughening up on punishment for financial fraud and false reporting.