Trade to remain subdued in 2013 after sluggish growth in 2012 as European economies continue to struggle

2013-04-11 12:35:25

World trade growth fell to 2.0% in 2012 — down from 5.2% in 2011 — and is expected to remain sluggish in 2013 at around 3.3% as the economic slowdown in Europe continues to suppress global import demand, WTO economists reported on 10 April 2013. “The events of 2012 should serve as a reminder that the structural flaws in economies that were revealed by the economic crisis have not been fully addressed, despite important progress in some areas. Repairing these fissures needs to be the priority for 2013,” Director-General Pascal Lamy said.

The abrupt deceleration of trade in 2012 was attributed to slow growth in developed economies and recurring bouts of uncertainty over the future of the euro. Flagging output and high unemployment in developed countries reduced imports and fed through to a lower pace of export growth in both developed and developing economies.

Improved economic prospects for the United States in 2013 should only partly offset the continued weakness in the European Union, whose economy is expected to remain flat or even contract slightly this year according to consensus estimates.

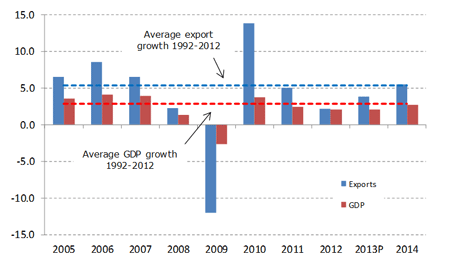

China’s growth should continue to outpace other leading economies, cushioning the slowdown, but exports will still be constrained by weak demand in Europe. As a result, 2013 looks to be a near repeat of 2012, with both trade and output expanding slowly, below their long-term average rates (Chart 1).

“The events of 2012 should serve as a reminder that the structural flaws in economies that were revealed by the economic crisis have not been fully addressed, despite important progress in some areas. Repairing these fissures needs to be the priority for 2013,” Director General Pascal Lamy said.

“Attempts by developed economies to strike a balance between short-term growth and increasingly binding fiscal constraints have produced uneven results to date, and finding an appropriate mix of policies has proven to be challenging. Similarly, the amount of progress that developing economies have made in reducing their reliance on external demand is still unclear.

“As long as global economic weakness persists, protectionist pressure will build and could eventually become overwhelming. The threat of protectionism may be greater now than at any time since the start of the crisis, since other polices to restore growth have been tried and found wanting.

“To prevent a self-destructive lapse into economic nationalism, countries need to refocus their attention on reinforcing the multilateral trading system. Trade can once again be an engine of growth and a source of strength for the global economy rather than a barometer of instability. The way is before us, we only need to find the will,” Mr Lamy said.

Chart1: Growth in the volume of world merchandise trade and GDP, 2005-14a

Annual % change

a Figures for 2013 and 2014 are projections.

Source: WTO Secretariat.

The preliminary estimate of 2.0% growth for world trade in 2012 is 0.5 points below the WTO’s most recent forecast of 2.5% from September 2012. The deviation is mostly explained by the worse than expected second-half performance of developed economies, which only managed a 1% increase in exports and a 0.1% decline in imports for the year. The growth of exports from developing economies (which for the purposes of this analysis includes the Commonwealth of Independent States) was in line with earlier predictions, but the rate for imports was less than expected. WTO economists cautioned that their trade forecasts for 2013 and 2014 were difficult to gauge due to divergent outlooks for the US and EU.

These figures refer to merchandise trade in volume terms, i.e., adjusted to account for inflation and exchange rate movements, but nominal (dollar-value) trade flows for both merchandise and commercial services display similar trends.

In 2012, the dollar value of world merchandise exports only increased two tenths of one per cent (i.e. 0.2%) to $18.3 trillion, leaving it essentially unchanged. The slower growth in the dollar value of world trade compared to trade in volume terms is explained by falling prices for traded goods. Some of the biggest price declines were recorded for commodities such as coffee (–22 %), cotton (–42%), iron ore (–23%) and coal (–21%), according to IMF commodity price statistics.

The value of world commercial services exports rose just 2% in 2012 to $4.3 trillion, with strong differences in growth rates across countries and regions. For example, the US saw its exports of commercial services climb 4% while those of Germany dropped 2% and France’s tumbled 7%. On the import side, several European countries recorded sharp declines, including Italy (–8%), France (–10%), Portugal (–16%) and Greece (–18%).

The trade forecast for 2013 assumes 2.1% growth in world output at market exchange rates (unchanged from 2012) based on a consensus of economic forecasters. Risks to the forecast are firmly rooted on the downside and are mostly linked to the sovereign debt crisis in Europe.

Accelerated fiscal consolidation in the US could also undermine the forecast if brinksmanship over budget negotiations between the executive and legislative branches leads to miscalculation. As always, unexpected events such as geopolitical tensions and natural disasters could also intrude to disrupt trade.

On a more positive note, some factors that held back trade growth in 2012 may subside in 2013, including the recent territorial dispute that soured trade relations between Japan and China.

Indicators of production, business sentiment and employment in the first quarter of 2013 paint a mixed picture of current economic conditions. Purchasing managers’ indices suggest that the euro-zone downturn may have accelerated despite continued resilience in Germany. At the same time, the US recorded a strong rise in manufacturing, Japan’s production growth was less negative, and China and the Republic of Korea showed modest improvements.

Unemployment in the US recently fell to its lowest level since before the economic crisis at 7.6%, whereas the rate for the euro area stands at close to 12%. Together, these indicators point to weak import demand in Europe even as conditions gradually improve elsewhere. In light of the large weight of the EU in world imports (32% in 2012 including trade within the EU, 15% excluding it), this suggests slow growth for trade in the early part of 2013.

Prospects for 2013 and 2014

The outlook for world trade and output in 2013 and 2014 looks unsettled, as positive economic trends have also been accompanied by more worrisome developments.

EU output fell in the fourth quarter of last year as the slowdown in Europe finally touched Germany. Monthly indicators of economic activity in January and February suggest that the German economy remained relatively resilient in the first quarter, but the downturn in the rest of the euro area appeared to be intensifying. Most forecasters expect European economies to remain weak in the first half of 2013 before gaining strength later in the year.

Unemployment is falling gradually and private expenditure is picking up in the US, but automatic government spending cuts set to take effect in 2013 could weigh on growth later in the year. Political gridlock may be easing, which could allow more targeted and less sweeping measures to be agreed, with less risk to a promising recovery. The Federal Reserve has signalled that its most recent program of quantitative easing will not be withdrawn hastily, but as the economy picks up transitioning to a less accommodative policy stance could prove challenging.

Japan’s new government has prioritized a sizeable fiscal stimulus package and a more accommodative monetary policy as a way to spur economic growth. The former may test the limits of fiscal policy given the size of the country’s public debt — estimated by the IMF to exceed 200% of GDP — while the latter may invite charges of currency manipulation. Stimulus-oriented policies will probably provide a boost to Japanese growth and trade in 2013, but how much remains to be seen.

Although China’s exports may be hindered by the slowdown in Europe, increased shipments to the US should partly make up for this. Until recently the EU was China’s largest trading partner, but the drop in EU imports in 2012 left it in second place behind the US. China’s GDP growth is expected to remain strong compared to the rest of the world in 2013, which should provide support for imports from other countries.

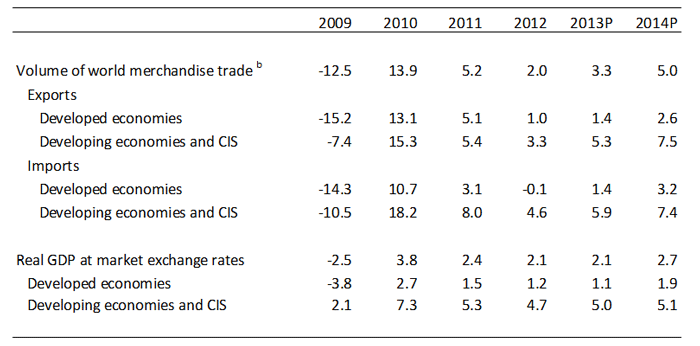

In light of these developments, WTO economists are forecasting a small pickup in world trade volume growth to 3.3% in 2013 from 2.0% in 2012. Exports of developed economies should increase by 1.4% while those of developing economies (including the Commonwealth of Independent States) should rise 5.3%. On the import side, the WTO anticipates 1.4% growth in developed economics and 5.9% in developing economies plus CIS. (See Table 4.)

Figures for 2014 are provisional estimates based on strong assumptions about the medium-term trajectory of gross domestic product (GDP) and should be interpreted with care. World trade volume growth for that year is expected to improve to 5.0%. Exports of developed and developing economies should increase by 2.6% and 7.5%, respectively. On the import side, developed economies should advance by 3.2% while developing economies should rise 7.4%.

The current forecast could be derailed if certain downside risks materialize. These include revived financial market turbulence related to the euro crisis, commodity price spikes, geopolitical tensions, and rising protectionism.

Table 4: World merchandise trade and GDP, 2008-2014a

Annual % change

a Figures for 2012 and 2013 are projections.

b Average of exports and imports.

Source: WTO Secretariat for trade, concensus estimates of economic forecasters for GDP.

Trade could still surprise on the upside if Europe returns to growth more quickly than anticipated. However, the most likely result is very similar to last year: a mild recession in the EU restraining exports and imports in both developed and developing economies.

The trade forecast assumes a 2.1% increase in world GDP for 2013, with developed economies growing 1.1% and the rest of the world growing 5.0%. The 2014 projection assumes world output growth of 2.7%, with developed economies advancing 1.9% and the rest of the world growing 5.1%. The output figures above refer to real GDP at market exchange rates based on consensus estimates of economic forecasters.

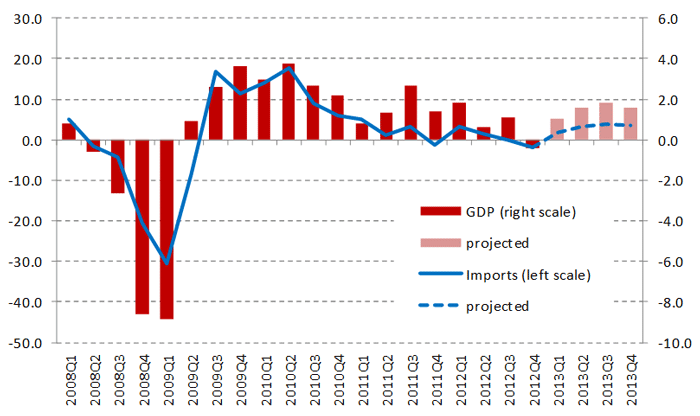

These estimates of export growth are supported by results from of the WTO Secretariat’s quarterly time series forecasting model, which predicts an increase of around 2.5% in imports of goods and services for OECD countries in 2013 (Chart 8). Difference between the two approaches can be explained by the use of different weights in the two models (GDP weights vs. trade weights) and by the fact that the WTO’s definition of developed economies differs from the membership of the OECD.

Chart 8: GDP and import demand for OECD countries, 2008Q1-2012Q4a

Annualized % change over previous quarter

a Figures for 2012 and 2013 are projections.

Source: OECD for trade and GDP through 2011Q4. Consensus estimates of forecasting agencies for GDP

projections and WTO Secretariat for trade forecasts.