The Week of 02.02.2011-07.02.2011

2011-02-07 14:57:35

We have returned to producing the weekly after a two week break, as we have completed building our site www.uaindex.net. The site will be your source for daily information and from it we will draw the best stories for our weekly. If there are questions regarding registration please don’t hesitate to contact me at bohdan_chomiak@ukragroconsult.org.

The week was interesting for Ukrainian agriculture and the highlight was Interagro 2011, the national agricultural trade fair. We had a good opportunity to participate, taking part in three round tables, one of which was sponsored by our parent company Ukragroconsult. From our perspective there was three bits of interesting news from the fair.

First was the statement from the head of IFC Ukraine Elena Voloshyna, who said that the president and government of Ukraine were told at Davos and in Kyiv that enough is enough and that its time the government lifted export quotas. That same day, Wednesday, February 2, the government published a resolution to lift quota on Corn exports.

Second, in speaking with input suppliers, producers and bankers at the fair, everyone was positive. We heard that some equipment dealers sold as much as $20 million of equipment, and bankers were touting new credit products. Generally, the news was that supplier credit and leasing supported by commercial banks was again available. This confirmed that lending will increase, and terms will improve. On some products such as granaries and some farm equipment, offered rates on 36 to 60 month loans were as low as 5% (granaries) to 13% (farm equipment). Straight operational loans remained at 18 to 22 percent. Still better than last year when hardly any supplier credit was available and rates started at 22%.

The third issue everyone discussed was the global commodity market. Everyone was bullish, and we were surprised that we saw few representatives from the big agro holdings at the fair. Regardless that the big boys were not out playing with the others, and we estimate attendance will be over 30,000, no one ignored the news that an agricultural boom was underway.

The news came from everywhere. From Davos we received the report, “Realizing a New Vision for Agriculture: A Roadmap for Stakeholders,” released Jan. 28. The report’s plan targets ambitious objectives of 20% increases in agricultural production, 20% decreases in greenhouse gas emissions per tonne and 20% reductions in global poverty each decade to 2050. The forum’s New Vision for Agriculture initiative was led by 17 global companies, more than half of which are U.S. based — Archer Daniels Midland Co.; BASF; Bunge Ltd.; Cargill; The Coca-Cola Co.; E.I. du Pont de Nemours and Co.; General Mills, Inc.; Kraft Foods Inc.; Metro AG; Monsanto Co.; Nestle S.A.; PepsiCo, Inc.; SABMiller; Syngenta A.G.; Unilever; Wal-Mart Stores, Inc., and Yara International.

“The (agricultural) sector is entering a new era, marked by scarcer resources, greater demand and higher risks of volatility,” the report said. “Since agriculture accounts for 70% of water use and up to 30% of greenhouse gas emissions, it contributes to and is threatened by environmental degradation. This will be exacerbated as the growing population demands more food — nearly double today’s levels by 2050 — and more resource intensive produce such as meat and dairy.” The group noted that hunger afflicts nearly 1 billion people around the world, half of whom are farmers.

FAO also kicked into the discussion with its release of a report on world food prices which according it have now exceeded highs set in 2008. However our attention was captured by two other reports, one from PWC – “The World in 2050” and Rabobank’s “Sustainability and Security of the Global Food Supply Chain”.

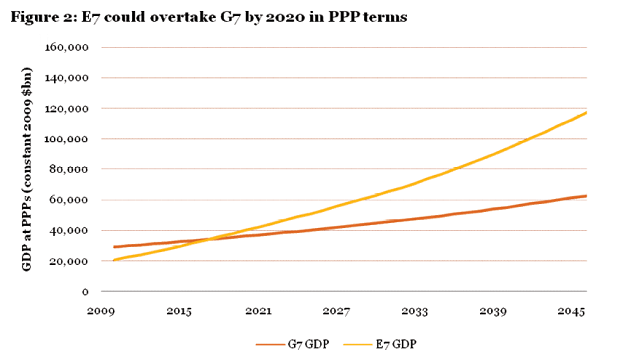

Our key take away from the PWC paper, which can be found at their site, was the economic analysis pointing to the gradual waning of the G7 countries and their overtaking by the E7 countries - China, India, Brazil, Russia, Indonesia, Mexico and Turkey. The paper provides good reason why this will occur, but one graph is particularly convincing: