Fourth quarter offerings provide positive IPO news heading into 2012, Says PwC

2012-01-17 18:11:21

A number of new offerings in the fourth quarter – spurred by Groupon – helped to jump-start the U.S. IPO markets in November after a significant drop in third quarter pricings due to high market volatility, according to PwC US. The market reignited in December with the return of larger offerings, including Michael Kors and Zynga, which combined with Groupon and Delphi raised $3.2 billion –half of fourth quarter total proceeds. The surge in activity and relative strength in the number and diversification of industries in the IPO pipeline are early signs of a healthier IPO market in 2012, according to IPO Watch, a quarterly and annual survey of IPOs listed on U.S. stock exchanges by PwC’s Transaction Services practice.

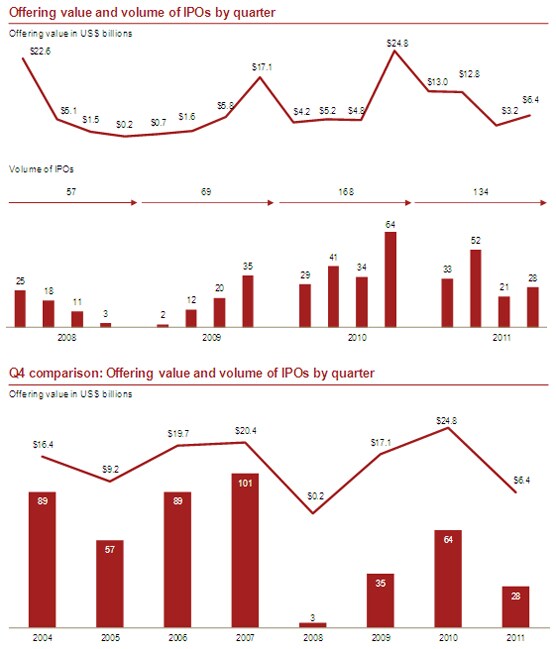

As of December 16, there were 28 pricings which raised $6.4 billion in the fourth quarter 2011 – three of which priced in October, fourteen in November and eleven in December, to date. When compared to a very active fourth quarter in 2010, which saw 63 IPOs worth $9 billion (excluding General Motors’ $15.8 billion offering), IPO activity saw a 29 percent decrease in proceeds. A surge in activity in November initiated by the highly-anticipated Groupon IPO included 14 pricings that raised $2.6 billion in the span of just two weeks. The third week in December was equally active, reaching $3.2 billion with nine pricings. According to PwC, the fourth quarter was characterized by a number of larger offerings, which helped drive an increase in average deal size to nearly $230 million, a 51 percent increase over an average deal size of $152 million witnessed in the third quarter of 2011.

Similarly, the return of larger deals in the first half of 2011, including HCA Holdings and Kinder Morgan, which raised approximately $3.8 billion and $2.9 billion, respectively, contributed to a 53 percent increase in 2011 proceeds to date when excluding General Motors’ $15.8 billion from 2010 total proceeds. Year-to-date through December 16, there were a total of 134 IPOs that raised $35.4 billion in 2011, compared with 168 IPOs and $39 billion raised in 2010.

“A number of blockbuster IPOs in the last few weeks of 2011 has sparked a renewed confidence in the U.S. IPO market, which bodes well for 2012. Potential issuers and the investment community are watching the market very closely to see how IPOs perform, as evident by bellwether offerings causing the window to reopen for short periods of time during the fourth quarter,” said Henri Leveque, leader of PwC’s U.S. Capital Markets and Accounting Advisory Services. “Not only must issuers be nimble enough to navigate the markets once the window opens, they will also need to position themselves in a competitive environment with lots of companies in the pipeline vying for investors’ attention. Unresolved macroeconomic issues could continue to cause uncertainty for the near-term outlook, but will not hinder issuers’ willingness or appetite to complete an IPO when conditions are right.”

New filing activity remained robust during the fourth quarter, with 38 companies entering the IPO registration process. Energy companies led IPO pipeline entrants with eight potential new issuers, followed by consumer companies with seven filings and healthcare and financial services companies with six each. In the fourth quarter, eight companies withdrew IPOs after filing to go public earlier in 2011.

The current year-to-date pipeline includes 164 companies, with the four top industries contributing 68 percent of volume: industrial, technology, energy and financial services. According to PwC, the relative strength in the pipeline is a positive indicator that raising capital via an IPO remains a very viable option in the U.S. markets.

“The backlog of companies waiting to access the capital markets may lead to a significant increase in pricings in 2012 as the markets gain more momentum,” continued PwC’s Leveque. “Companies in registration are planning for the long-haul and are using the periods of downtime wisely to take actions to further ready their internal organization for being public when the opportune time arrives.”

Eighteen of the 28 IPOs in the fourth quarter 2011 to-date were backed by a financial sponsor (either a private equity or venture capital firm), which accounted for $4.9 billion of total quarterly proceeds. According to PwC, financial sponsored IPOs contributed 77 percent of total proceeds in the fourth quarter. Financial sponsor-backed companies also represent 54 percent of the current year-to-date IPO pipeline, showing continued interest from private equity to use the equity markets as an avenue to exit.

“Financial sponsors have demonstrated experience in navigating volatile markets to achieve their goal of earning a positive return on their investments. With many portfolios companies in the pipeline, it is expected that private equity will continue to look to the equity markets as an exit option for their portfolio companies, while pursuing ‘dual-track processes’ for potential M&A prospects,” added Howard Friedman a PwC partner specializing in IPO execution.

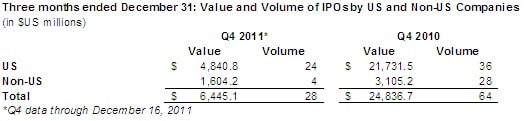

The fourth quarter of 2011 continued to witness a steep decline in the volume of foreign issuers coming to the U.S. IPO market. In the current quarter, there were only four foreign offerings compared to 28 pricings in the fourth quarter of 2010. The main contributor for non-U.S. proceeds in the quarter was Hong Kong domiciled Michael Kors which raised $944 million.

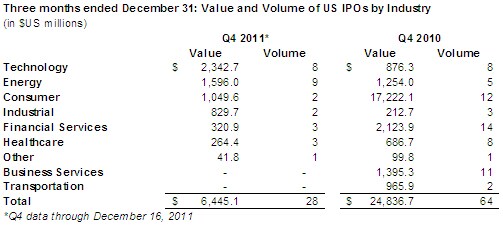

In terms of sectors, the U.S. IPO market has maintained a diverse range across different industries, according to PwC. Energy and technology companies were particularly active, contributing nine and eight offerings, respectively, in the fourth quarter of 2011. Other industries that contributed to the majority of proceeds raised in the fourth quarter included consumer and industrial companies.

Pricing remained a challenge in the quarter, in which only four offerings priced above their projected ranges while twelve priced below the projected range. The remaining twelve priced within their projected ranges. On average, fourth quarter pricings increased 5 percent one day after pricing and approximately 6 percent one week following their IPO. The consumer industry, helped by the Michael Kors offering, had the highest average day one return of approximately 18 percent while the technology industry had highest average one-week return of approximately 22 percent.